If you are among the traders who make money in Forex consistently, you are highly regarded as one who has achieved a great feat.

Because 95% of traders do not make profits consistently. When I first started trading, I was in the boat of trading and not making profits for a long time. Trust me, during that period, boys were not smiling at all, lol. It seemed to me like I was just going to work everyday for over 4 years and not getting paid. But I am glad I did not give up.

The breakthrough came when I started to do what I am about to share with you. I encourage you to pay attention to see where you are missing it and adjust immediately. Don’t waste anymore time.

How I Started To Make Money In Forex

1. Speaking To Myself;  I took out my journal one Friday after market closed and started to write like I was writing an exam. I asked myself questions like;

I took out my journal one Friday after market closed and started to write like I was writing an exam. I asked myself questions like;

”Why do I keep losing my profits back to the market?

”Why do I think that other traders’ signals are better than mine?

As I asked those questions, I also wrote down the answers. I noticed that I was losing my profits back to the market because I was not content with the little the market was giving me. Instead of accepting $50, I was waiting to get $100 and in the process the trade reversed and my floating profit floated away.

Does this sound like what you experience too? Here’s what I did.

I decided there and then that I was going to start being content with what the market was giving me.

So if the market gives you $100 today, instead of aiming to get more immediately, take the one you got and say, ” Oga market thank you oh”, lol. I started to do this and my trading account started to grow.

Also, I noticed that I was believing more in the so called ”forex experts” on social media. That had a negative impact on my psychology. What I did was to unfollow them immediately. I started to believe in myself and focus more on my trading.

2. Getting Good Technical Knowledge;

Because I stopped depending on signals and social media traders, I had to get more serious with studying and making researches. I learned to read the price chart for myself, using candlesticks, trendlines, support and resistance and the likes.

It was difficult at the time because I had no mentor, so I was doing all the work by myself. I made out time to always study after I had done my 9-5 job and it eventually paid off. If you work a 9-5 job, read here to find out some tips that you can apply to work and trade at the same time.

If you are just starting out as a trader, I strongly advise that you get a mentor who trades. Don’t fall for traders who sell courses but do not trade.

If you would like to join my trading community and get access to my mentorship, click here to sign up

2. Accepting To Take A Loss

One of the things that slowed down my progress was that I was too careful with my capital. I did not want to lose anything. Whenever I took a trade, once there was a slight pull back, I would quickly run out and close the trade in a loss. My losses were accumulating little by little because of this act until my account was in a big drawdown.

I was tired and then I said to myself, ”ENOUGH IS ENOUGH!” If you find yourself doing this too, here’s what I did.

Before taking a trade, I ask myself if I am happy to take a loss on the trade, if I am not happy to take a loss on the trade then why place the trade? Do you get the gist? You have got to make up your mind to accept the loss before you click the buy or sell button.

3. Focusing On Risk To Reward

If you have been following me for a while, I have said it a lot of times that I like to pay attention to having a good risk to reward. I learned it during the period I was still struggling to make money in Forex.

I started focusing more on targeting over 1;3 risk to reward and that really started to make a positive difference on my trading account. Recently, I made £60,000 on a single trade. The RR on that trade was 30:1. You can read about it here. A good risk to reward ratio will always make money in Forex.

5. Following the Process;

I always say that I realized early that risk management is very key in this space. So I have been a good risk manager from the start. I also managed my trade better by focusing more on the chart than the money(floating profit or loss). If you have closed your trade out of fear of losing back your profit, raise your hand, lol. I know that feeling, right?

When you start to practice what I mentioned in 2 above, you will not need to run away when no one is chasing you, lol.

Picture this. Your trade is in a floating profit of $500 then it later reduces to $100. You close the trade out of panic but the market later moves back in your direction and even past your target area.

You become so sad and you wonder why your village people won’t let you be, lol.

Have you been in this position before 🙋♂️? I have been there too so nothing to feel bad about 😄

But here’s what I did.

I stopped looking at the floating profit or loss and paid more attention to the chart.

Doing this will help you reason more logically. Looking at the profit or loss could trigger you to make decisions out of emotions instead of logic. So focus more on the price movement

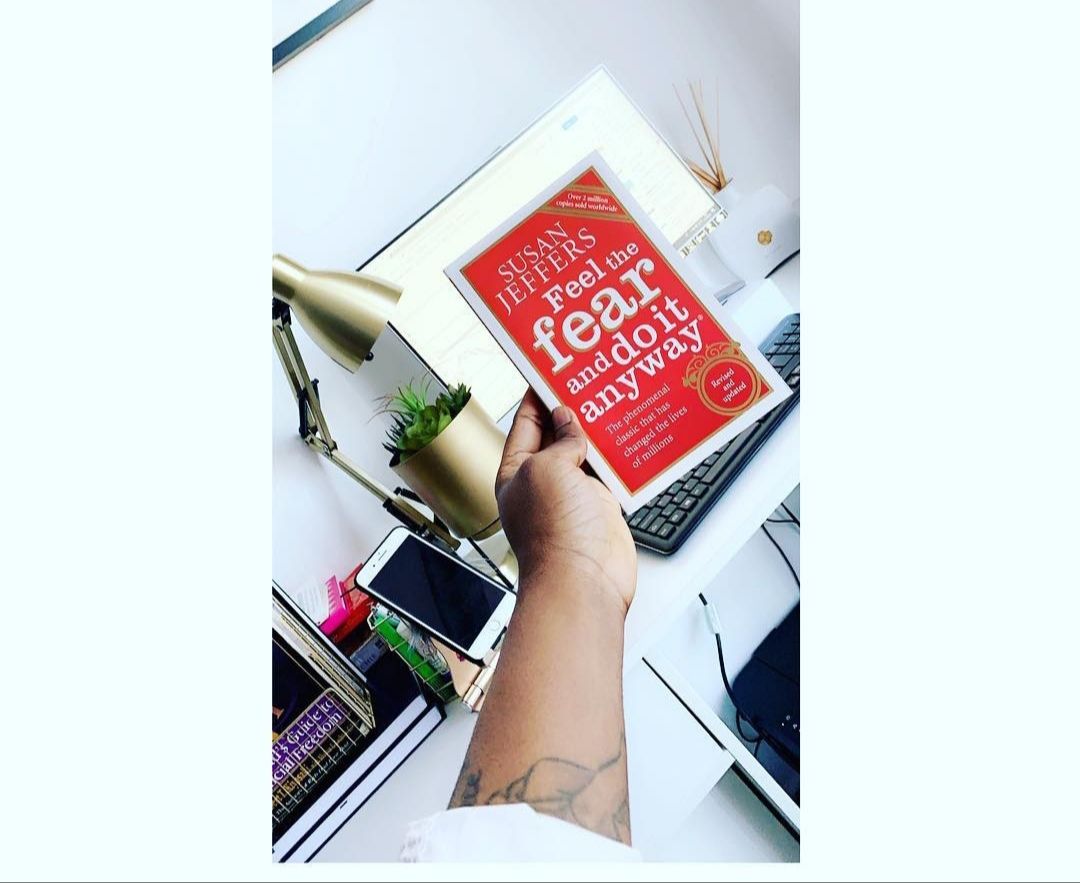

I put into practice all that I have highlighted in this article and my life is better for it today. You may not likely make money in Forex if you do not practice what I just shared with you here. If you feel scared about  taking action, read Susan Jeffers, ”Feel The Fear And Do It Anyway”

taking action, read Susan Jeffers, ”Feel The Fear And Do It Anyway”

In conclusion, one thing I have come to realize is that when you notice a high rate of failure in a particular field like Forex, observe how the majority of people there are handling things and start to do the opposite of what they are doing. You will most likely turn out to be successful.

Did you find this helpful? Please let me know in the comment below